Real estate in Kenya has seen a number of changes in property prices, supply and demand and the ever common affordable housing project which has been the talk of the town. We give you a break down of different categories in the real estate market report for 2019.

The sample size for this analysis is over 30,000 listings in Nairobi, Kiambu, Machakos and Kajiado which account for 96% of all listings that have been live on BuyRentKenya in 2019.

Table of Contents

LAND

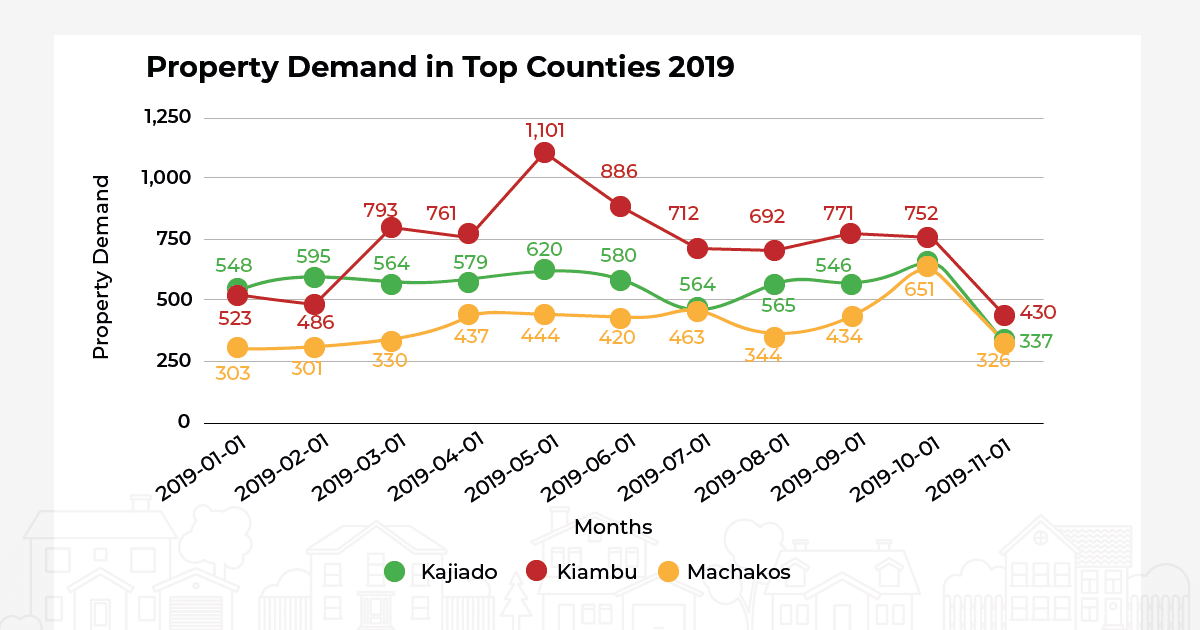

In 2019, demand for land started low in Q1, doubled in Q2, went down in Q3 and got worse in Q4. Land returns have gone up within the last decade compared to other assets like equities and government bonds which makes land the top investment bet.

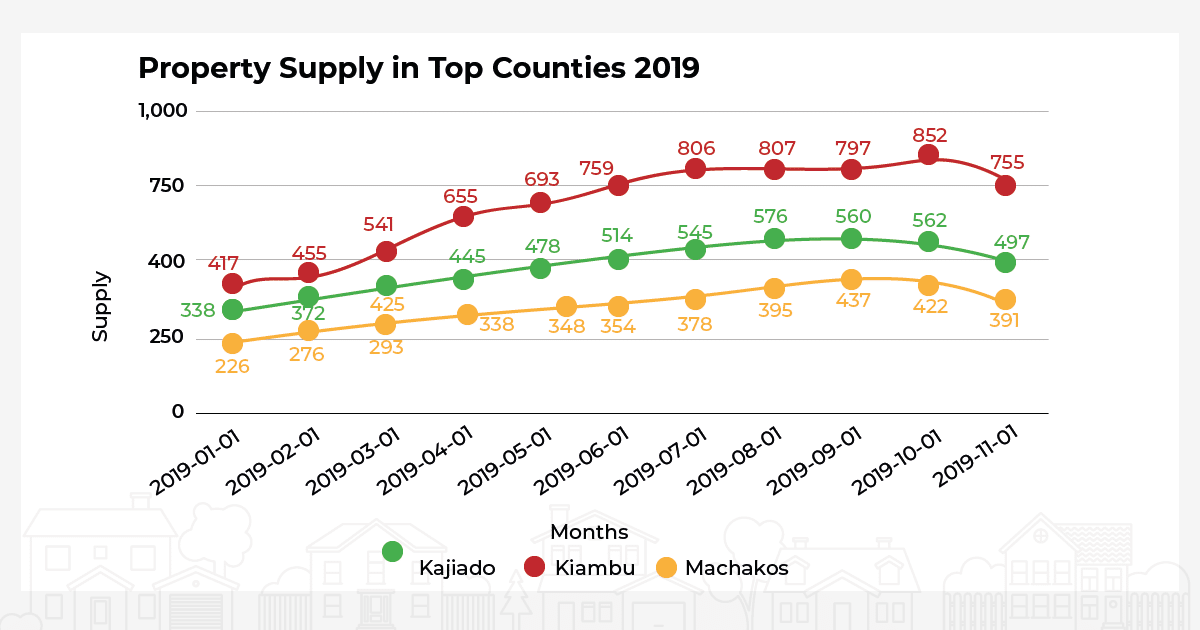

Kiambu county showed the most growth in supply in 2019. Demand for property in the area went up especially in places with coffee plantations. It comprises of more shopping malls and gated communities. This growth is from the growing middle-class community who prefer to live in satellite towns which are more affordable.

READ ALSO: Kiambu Neighbourhood Guide

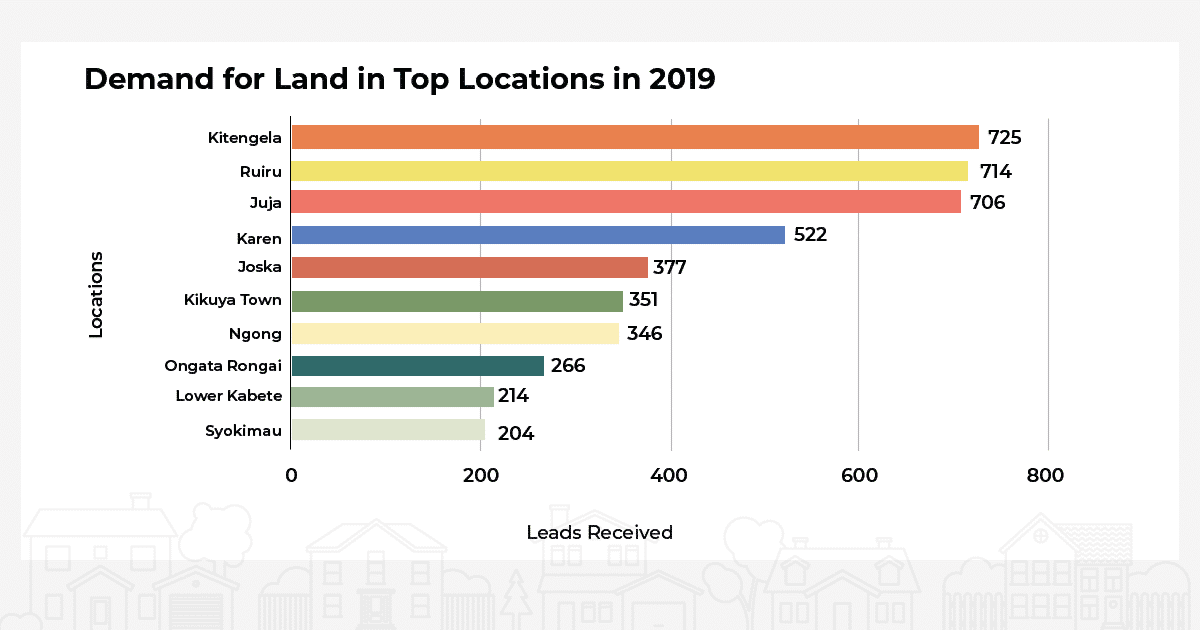

There was an increase in the value of properties in areas with large infrastructural improvements which affected early buyers. Before the Northern Bypass, an acre of land in Ruaka was an average of Kshs 40M but currently goes for Kshs 90M. This spike is due to an increase in demand for property in the area.

An acre of land in Ruaka is more expensive compared to other locations such as Kiambu Kshs 43M, Mlolongo Kshs 27.2M and Ruiru Kshs 25.6M. Infrastructural improvements which have made it easy to move around the town and the rise in commercial properties like Two Rivers Mall, people are investing in places Ridgeways and Ruaka.

Land Prices

Closer to the CBD, land prices are high and expected to remain consistent. For instance, we expect the price of an acre in these areas: Muthaiga Kshs 176.1M, Spring Valley Kshs 168.3M and Nyari Kshs 105.6M to remain fairly consistent. These high-end residential areas have high prices due to strict regulations which give restrictions on the amount of space where people can live. This is shown in the land prices in areas such as Kileleshwa which is Kshs 310M and Lavington with Kshs 237M where the zoning regulations are not as strict.

Kitengela and Ngong still maintain their high demand when it comes to land with an acre going for Kshs 24M. Kiserian remains the most affordable satellite town in terms of land with an acre going for Kshs 7.5M. Upperhill is the most expensive with an acre going for about Kshs 545M followed by Kilimani at Khs 433M.

READ ALSO: Land Trends Report – 2021 [Infographic]

Conflicting Data

There is a huge disparity between the value of land online vs value on the ground vs value at the land office. The data is very hypothetical and lacks transparency. With more data, buyers and sellers can make better decisions when investing in land. For example, land values in Nairobi are very flexible. They are going down in various nodes by 25%-30% and in some cases by 50%. At the end of the day, there will always be someone willing to buy the land.

Land use has become very flexible making the values very distorted e.g. with the shift from agricultural to commercial land in Kiambu e.g. the land where Two Rivers Mall is situated was historically affordable and agricultural land but since the Mall opened all that has changed. We expect a boost in the land space if the interest cap is scraped and applicants receive better terms.

RESIDENTIAL

Finding affordable property in the capital becomes a rumour YoY. The worsening economic state is leading home seekers to remote areas such as Ruaka and Rongai. The average price of a house in Nairobi shot up from Kshs11.5M in January 2013 to Kshs 32M in October 2019. The price of a 4 to 6 bedroom goes for Kshs 39.1M, while a 1 to 3 bedroom is Kshs 15M.

More people are opting for modern affordable houses in places like Ongata Rongai, Mlolongo, Limuru, Thika, Ruaka and Kitengela. There was an increase in the rent price in these locations from July to September.

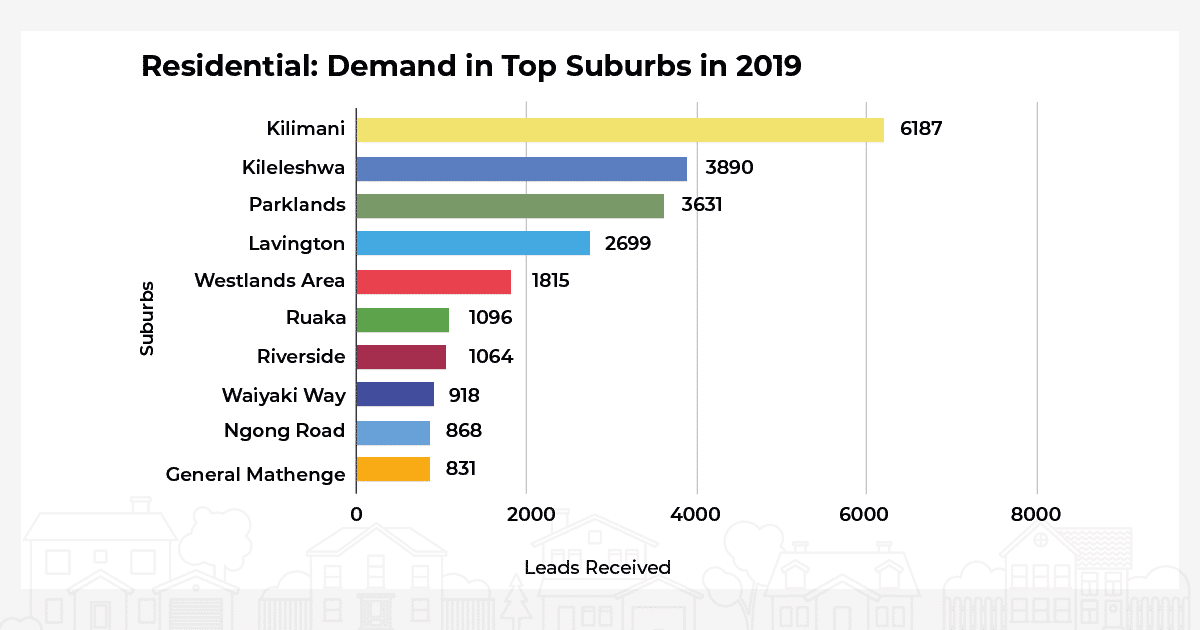

According to Cytonn, in the year 2018, Kilimani was the top suburb to receive approvals in apartments at 938 units, and then Parklands which had 565 apartment approvals. Kileleshwa had 495 and South B and C had 421 which shows that people are moving away from the stand-alone houses.

For example, a 1 bedroom apartment in Ruaka or South B is Kshs. 20,000 – 25,000 which sits well for many property seekers. They are looking for affordable housing as they try to save money. With the increase in the cost of living, people are choosing to spend more money on transport than rent hence more people opting to move to satellite towns outside the city centre.

READ ALSO: Guides to Nairobi Neighbourhoods & Suburbs

On the flip side, the population in Nairobi is growing. The government is working towards providing more affordable housing in estates such as Jeevanjee, Uhuru, Old Ngara, South C, Ngong Road and Pangani. The apartments will sit on the land which has the colonial era estates and will house close to 30 residents.

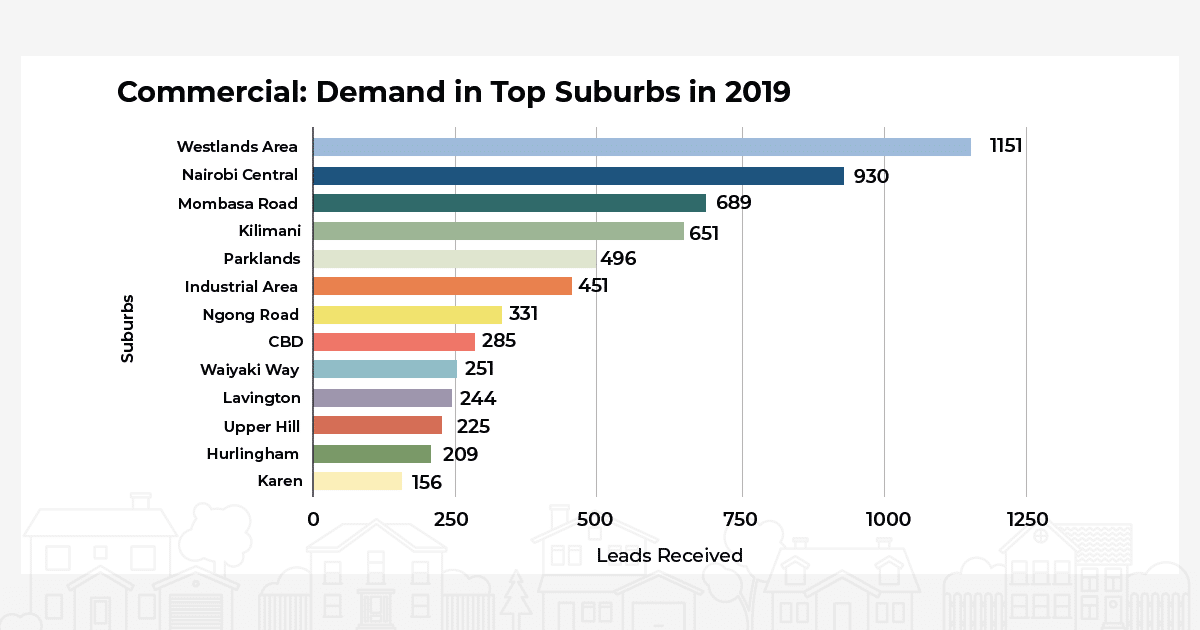

COMMERCIAL

Most of the offices are located along Mombasa Road with 14.1% office space while Parklands has 7.6%. Shopping malls/commercial spaces are posting huge losses with an ongoing oversupply. This is forcing landlords to cut rental charges to retain existing tenants. We expect this trend to continue.

Due to changes in the zoning policy, developers and landowners were able to build buildings that go up as high as 15 floors from the previous four-floor limit. Demand for property in Ruaka will rise because of easy accessibility to other parts of Nairobi. This means a rise in social amenities in Ruaka. There will be a spillover of companies setting up shop from areas such as Parklands and Westlands.

Developers are opting for vertical building concepts in a bid to maximise on available land and leveraging on air rights. There is still buying activity but with less confidence as people have a lot of uncertainty about the economy. According to Hass land index, demand for commercial land in the suburbs went up. This is because of the completion of Waiyaki Way to Redhill link road.

Challenges Affecting Real Estate

These include delays in processing construction permits, an oversupply of property and slow private sector credit growth. Despite the growth in areas such as affordable housing, the property sector is still experiencing a slowdown. Same as in tourism and foreign trade which are experiencing job cuts, low profit, hiring freezes and near stagnant wages.

Building lavish estates is now becoming a losing investment as Kenyans try to adjust to the tough economic situations. This we have seen with developments in the satellite towns outperforming those in the capital based on affordability.

Way To Go

Developers should focus on getting smaller profit margins and sell more units to avoid ending up with empty properties and going on a loss. The way to go about this is to find an entry point into affordable housing. This partly explains why there is a huge supply in the property market because people can’t afford what’s available.

Property seekers pay high prices because developers are also experiencing high costs in land, financing and infrastructural challenges which raises the cost of construction.

READ ALSO: 10 Low-Cost Construction Materials in Kenya for 2023