Disclaimer: We wrote this article before the Coronavirus pandemic. We will see other trends from the effects of the situation.

The dynamics in the real estate industry are constantly changing and 2020 is no different. We expect to see more price drops in certain places in Kenya, a rise in new technology trends and so much more. If there is a trend you need to be on the lookout for that will help your business and investments grow, then you need to be at the top of it.

In this article, we will discuss:

- Real estate price drops

- The affordable housing project and what it means to real estate firms

- Sustainable buildings

- Innovative ways of filling office spaces

- Using technology to grow leads and get more customers

- Growing demand for middle-income houses

Table of Contents

Real Estate Prices Drop in Satellite Towns

For the first time in a long time in Kenya, prices for houses in satellite towns dropped on an annual basis. This is because of the poor economy in the country which has caused property seekers to adopt a wait and see mentality before investing in real estate. With many units remaining vacant, landlords and developers were forced to reduce their prices to be in line with the ongoing trend to avoid the risk of losing business.

Ruaka has seen a significant 40% drop in house prices over the past 3 years from an average of Kshs 50,000 in 2017 to the Kshs 35,000 in 2020. This is coupled up with the shift in demand from houses which was the case 7-8 years ago to the current boom of apartments.

READ ALSO: Property Trends: How Agents & Developers Capitalize on Ruaka

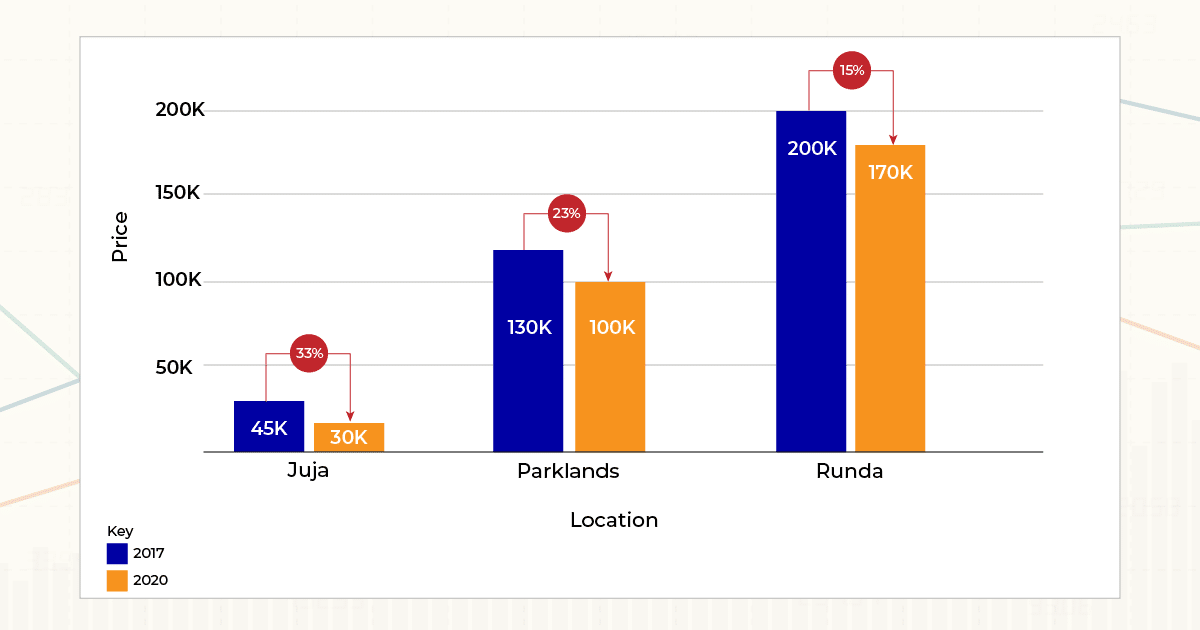

Average figures for Parklands, Runda and Juja of the drop from 2017 to 2020 for a 3b/d house.

Other locations in Nairobi are seeing the same trend. There was a 23% price drop in Parklands from Kshs 130,000 to Kshs 100,000 for a 3 bedroom house. In Runda, prices went down from Kshs 200,000 to Kshs 170,000.

Even as land remains to be the number one go-to investment opportunity according to a Standard Chartered survey, landlords should take advantage of this fact by not demanding too much from potential buyers especially in locations with a surplus of units.

Affordable housing project and what it means to real estate firms

More Kenyans are investing in the low-cost housing scheme, with over 280,000 applications already registered in the system. Kenyans are not purchasing the more expensive units sold by private developers. They have adopted a wait and see mindset in the hopes of getting cheaper options from the government.

READ ALSO: Boma Yangu Project – Affordable Housing Program in Kenya

The project is meant to provide low-costing housing but developers should not shy away from collaborating with the government just because it has low returns. It will change the narrative that is going around that property in Kenya is too expensive to own.

READ ALSO: KMRC’s Affordable Mortgage Options for Middle-Income Buyers

Additionally, with the exit of the old Kshs 1,000 notes and the government’s efforts to fight corruption, Kenyans are expecting some stability in the sector. Some people felt that a lot of “stolen” money was being sunk into the real estate sector.

Sustainable Smart Buildings

Smart buildings can change the real estate industry in various ways. Developers should embrace the idea of creating sustainable, smart spaces that consume less energy like the Tatu City which generates renewable energy to serve homes and other surrounding buildings.

READ ALSO: Homes of the Future: The Rise of Smart Homes

They should include more automation processes in their buildings and use technology to help reduce the carbon footprint. Solar energy can power buildings during the sunny season which will save electricity costs and take advantage of natural light.

Are smart buildings a viable option?

One major challenge with constructing smart buildings is the cost implications. It is an expensive process and requires expertise which is not easy to find in Kenya. This means that because of the high construction costs, buyers will pay high prices to cover up for the developer costs. What then does it mean for the already existing buildings? Will developers try to upgrade them to fit this narrative?

Innovative Ways of Filling Office Spaces

Walk around busy office parks and you will see how empty most of them are. Developers and landlords are now using smart tactics to get tenants. Some are giving discount offers, providing serviced offices which mean lower operational costs to the tenants.

Other companies are allowing tenants to pay rent for one month in cash and two months as a bank guarantee as opposed to the requirement of paying 3 month’s rent upfront.

Using technology to grow leads and customers

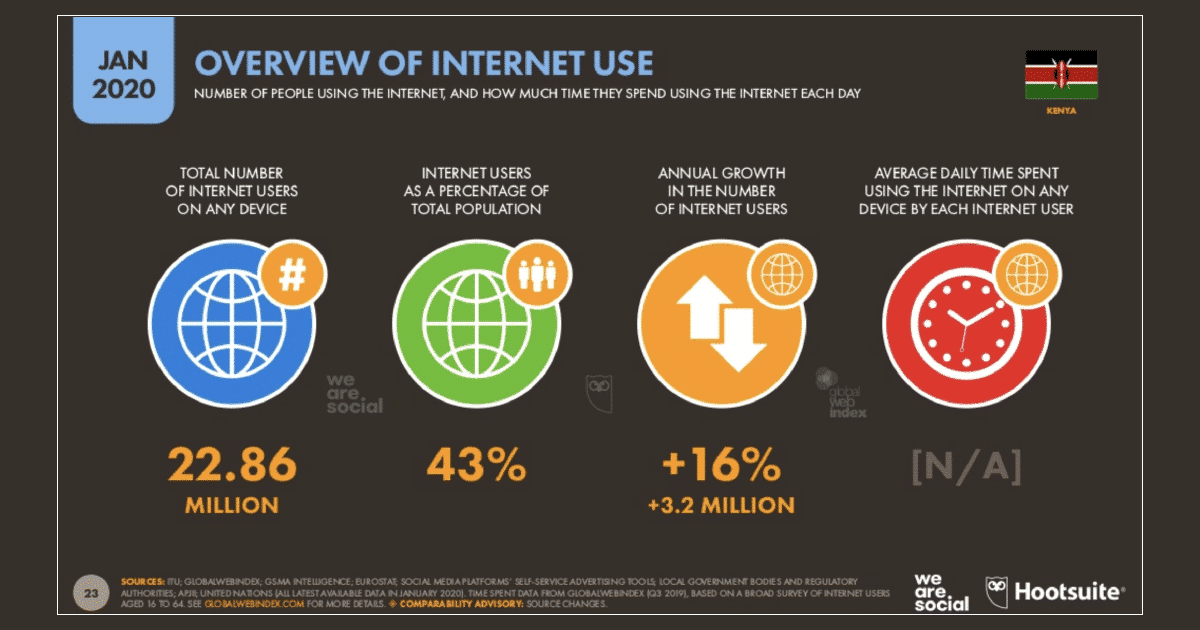

Technology is changing how real estate agents and developers are doing business. More and more real estate firms are embracing technology in 2020 by advertising their property on property portals such as BuyRentKenya. Looking at the statistics from DataReportal on the number of internet users, 22.86 million is a huge number to not take advantage of. Go where your customers are: online.

Growing demand for middle-income houses

Demand for affordable rentals is on the rise. Unfortunately, there is an oversupply of high-end, expensive properties which are mostly vacant in places such as Kilimani, Lavington, Westlands and Kileleshwa. Developers and estate agents should focus on providing rentals for the middle-income earners. Affordable rentals will continue to rise in places such as Ruaka, Lower Kabete, Roysambu and other locations further away from the city centre.

READ ALSO: Guides to Nairobi Neighbourhoods & Suburbs

As a real estate agent or developer, taking advantage of the above pointers will set you apart from your competition.

The global economy is witnessing changes from the coronavirus pandemic. The economy is getting weaker which means investors could end up buying because of a drop in real estate prices. Small and medium-sized businesses might have to lay off staff to stay afloat which will affect their financial capacity.