Historically, BuyRentKenya’s database has hosted over 50,000 listings since 2015.

We currently have 10,000 listings per month with an additional growth of 2,500 listings per month which guides our strong command in Real Estate in Kenya.

Through our national reach, we have established long-standing relationships with different stakeholders in the real estate sector to meet the needs of property seekers in Kenya.

There has been an upward trend on the number of listings on the BuyRentKenya portal with a 200% increase ratio in the number of people looking for property to the property listings in the last 5 years.

The growth is attributed to the rise in residential developments, malls, and the construction of the ByPass which has made transportation easier.

This article provides a comparative price change/demand/supply analysis in the past 5 years highlighting investment opportunities. The key variables considered in this analysis were house types, price range, size(bedrooms) and annual time period.

6-8 years ago, Ruaka which is in Kiambu County, was mostly had bare land with no real estate activity in the area like the surrounding Runda estate. Ruaka has grown over the years attracting investors who are building residential and commercial property in the area.

Table of Contents

Why Ruaka?

Ruaka’s growth is due to various factors:

- Presence of recreational facilities such as Two Rivers Malls, Village Market, Riviera Mall, the Tribe Hotel and Trademark Hotel.

- Improved infrastructure with the Northern ByPass linking to Kiambu Road connecting to other neighbourhoods such as Westlands, Runda, Waiyaki Way and Limuru

- Enhanced security from the presence of international organizations like the American Embassy, the United Nations and Hope Worldwide.

- Cheaper available land compared to the neighbouring surburbs such as Runda.

- Availability of unused bare land behind the properties along the main road which creates an opportunity for developers and agents to supply more properties to meet the ever-growing demand.

- The Ruaka Neighbourhood Guide has more reasons why demand for rental apartments is high in Ruaka.

Ruaka Property Performance

Rentals

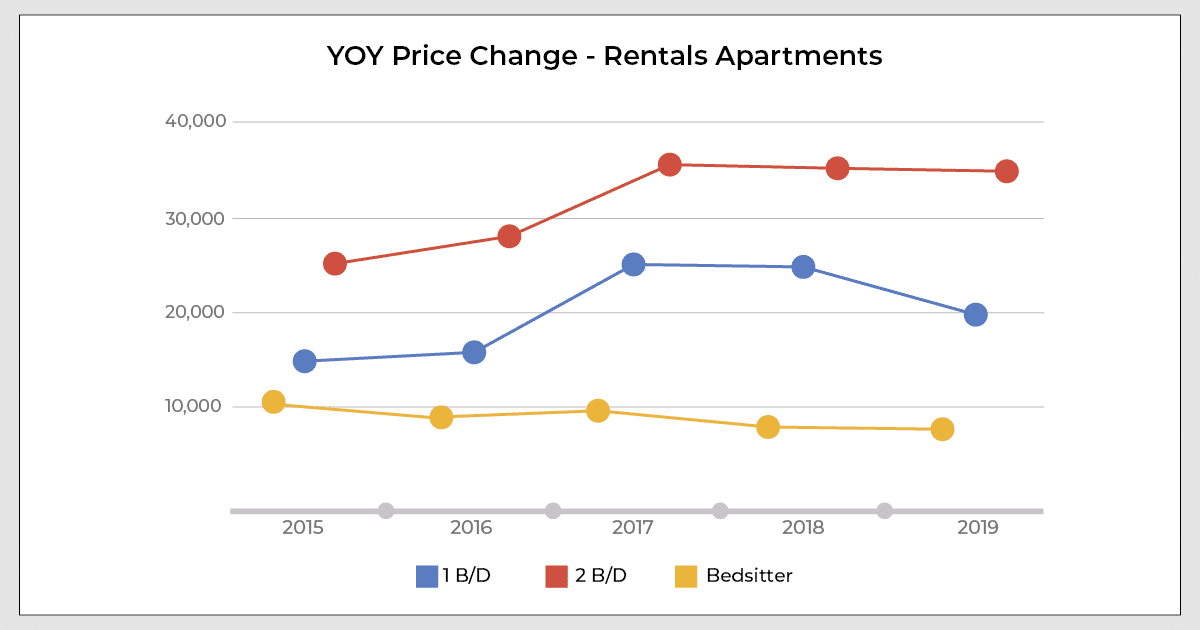

80% of the demand in rental property comes from Ruaka with most property seekers looking for bedsitters, 1 and 2 bedroom apartments. The average rates are shown below.

Between 2015 to 2017, prices were on a steady uphill trend mainly due to increased demand and limited supply. This was also because of the inflation rate in 2017 which was at 8%, the highest it had been since 2012.

In late 2017 and early 2019, there was a fluctuation in prices from the increase in bedsitters and 2 bedroom apartments. The high demand in these areas caught the attention of agents and developers which made them come up with fairer prices to meet the needs of the property seekers.

The political instability in 2017 and part of 2018 caused a drop in property prices in most parts of the country but we are seeing a change in pricing in 2019. The inflation rate drop from 8% in 2017 to 6% in 2019 is also another reason why we expect to see different pricing trends in Kenya. The government’s focus on providing affordable housing through the Big 4 Agenda, reduced costs in construction materials, have played a major role in the reduced property prices.

The price of a 2 bedroom apartment in Ruaka had initially dropped from Kshs 35,000 in Q2 2018 to Kshs 30,000 in Q1 2019. In the past 6 months, the price has shot up to Kshs 35,000 from high demand in the area. The same effect is seen with the 3 bedrooms apartment prices going up from Kshs 50,000 to Kshs 55,000 and bedsitters up from Kshs 6,000 to Kshs 8,000.

Sale

The price of a 3 bedroom apartment for sale is up from Kshs 10.5M to Kshs 13M between late 2018 (Q4) to mid-2019 (Q2) with prices expected to continue rising. We predict this trend will go on for the next year with an 8% increase by 2020.

Supply and Demand Analysis

Supply

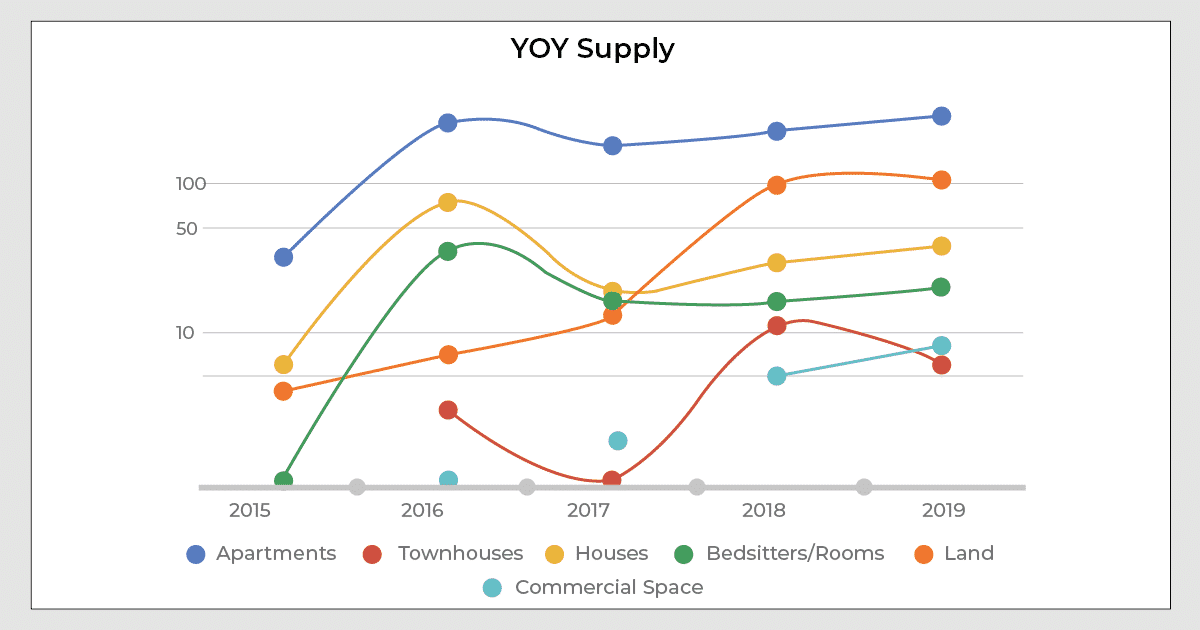

Ruaka has seen an increase in the supply of all property types YoY more significantly in apartments and land. In the next 12 months, we expect an increase in the property types in Ruaka and the surrounding areas.

Further out, in locations such as Banana and Ndenderu which are 3kms away from Ruaka, there is available land which means building more affordable townhouses/houses compared to the ones in surrounding suburbs like Runda are expensive. Affluent people such as expatriates looking for more living space would be the ideal market; however safety, convenience and accessibility is paramount.

Demand

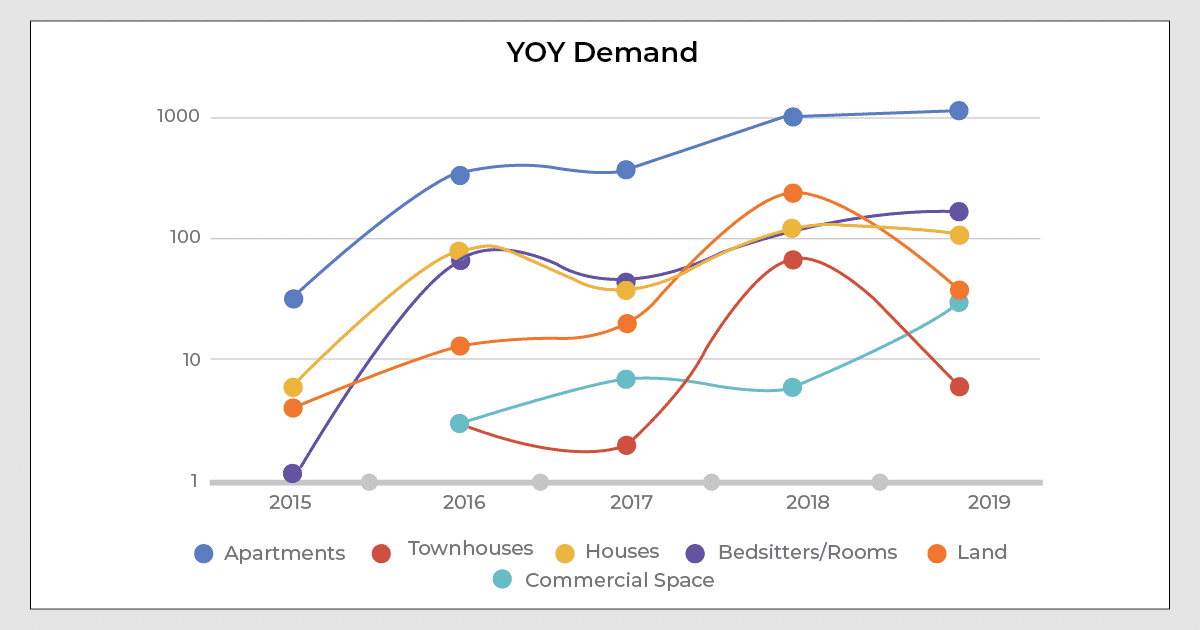

Most of the demand in Ruaka comes from young families to want to purchase their first home which in most cases is a 2 or 3 bedroom apartment. This shows from the social amenities within the area e.g. when it comes to schools, Ruaka has kindergartens showing the youthfulness of the demographic that lives here or it attracts.

With the shift to micro living, more property seekers prefer smaller affordable rental spaces hence the increased demand for bedsitters, 1 and 2 bedroom apartments.

Investment Opportunities

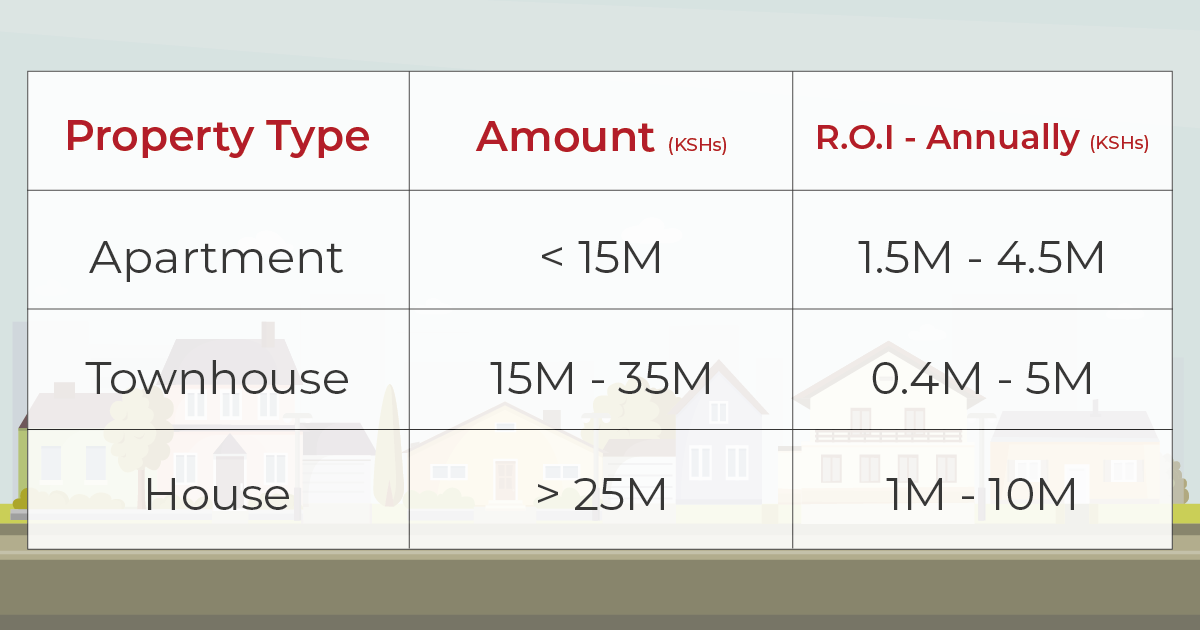

The size of the house, property type, proximity to local amenities, interest rates and inflation rates from the Central Bank of Kenya all affect the property price changes. Based on these factors and our research, these are the expected returns from Ruaka.

With an initial amount of less than kshs 15M, you can invest in an apartment ideally 2 or 3 bedroom or several bedsitters as they highly sort after. For amounts greater than Kshs 20M, you can build well-serviced townhouses and huge investments above Kshs 25M to Kshs 30M, invest in Houses.

Apartments have an approximate ROI between Kshs 1.5M and Kshs 4.5M p.a. On the other hand, townhouses priced between 15M and 35M have an expected ROI of Kshs 0.4M and Kshs 5M. The most expensive properties on the BuyRentKenya portal are houses. ROI can scale up to between Kshs 1M and Kshs 10M p.a.

To calculate price change, we track the changes in the price of the property relative to the price it had at a reference period in time (in this case Jan 2019).

Conclusion

People who rush to invest in real estate without doing proper market research end up experiencing long periods of negative cash flow waiting to make their returns which may never happen. They could end up selling the property at a loss or going bankrupt trying to finance a mortgage. To avoid getting yourself in such

NB: Data used in computing price change and volume was sampled to reflect properties in Ruaka between 2015-2019.

For more information contact: Robert Ombaka – Business Analyst

Email: roberto@roam.africa or robert@buyrentkenya.com