What are the most important real estate trends to watch out for in 2022?

From changes in demand and pricing to the preferred advertising channel for most property seekers, here are trends on what has been happening and predictions on what is coming.

Table of Contents

1. Drop in Demand

There was a shift in demand towards the end of 2021 from rental to sale in specific property types and locations.

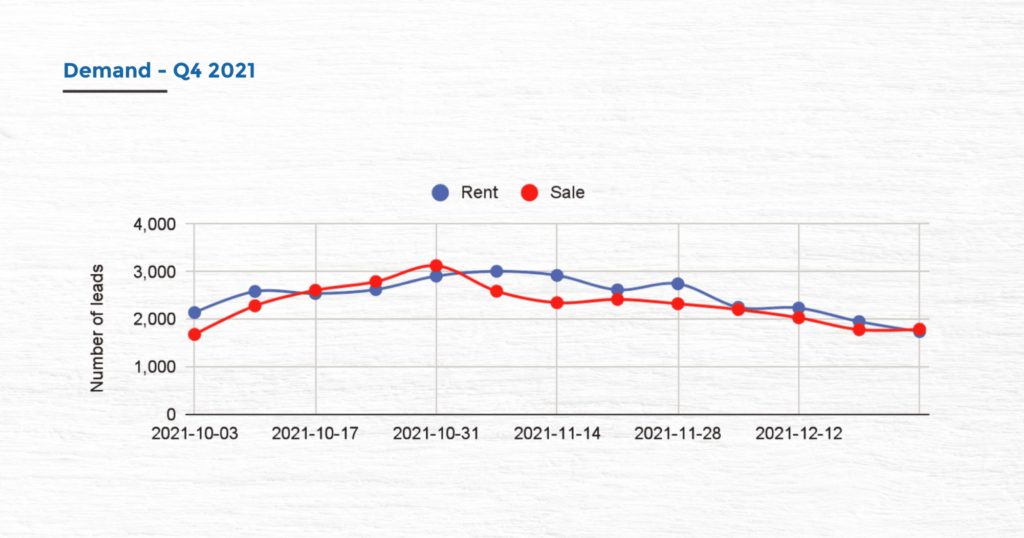

Above, we see demand trend lines for the last 13 weeks of 2021 in the rent vs sale category. Sale leads dropped at a lower rate of 3% to level up with rental leads that dropped to an 8% rate.

Land and residential properties were the major influencers towards this growth, most notably in Joska, Juja, Athi River.

2. Drop in Prices

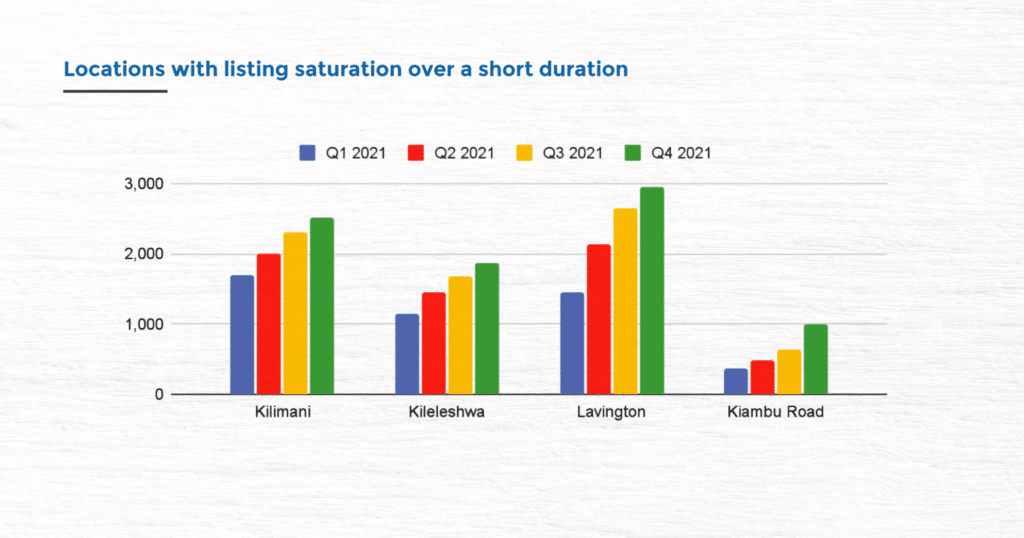

There was an oversupply in specific locations that led to drops not only in demand but also in pricing (house price change dynamics)

Areas such as Kilimani, Kileleshwa, South B and South C, and parts of Eastlands are perfect examples of this trend, especially for apartments and bedsitters, as shown in the charts below.

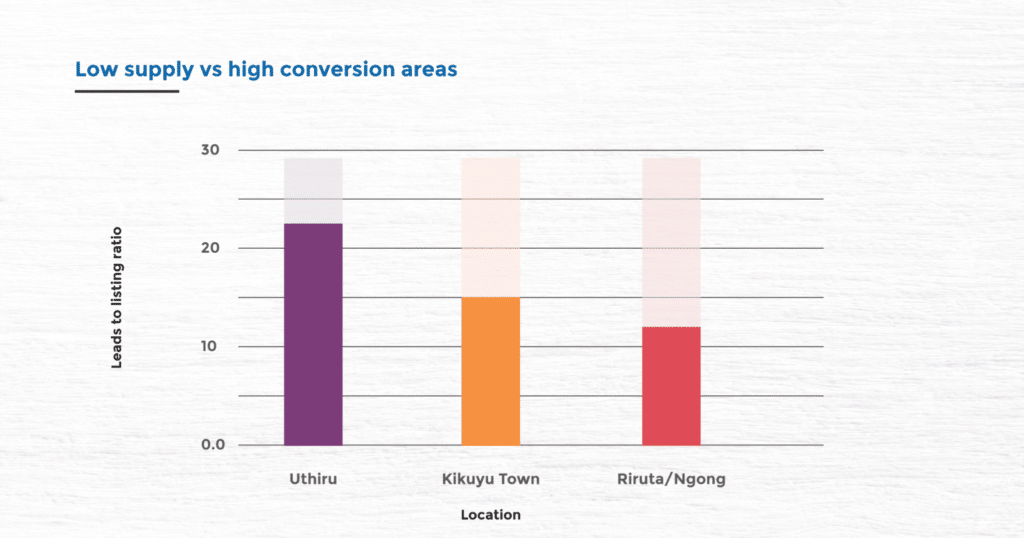

The below graph means that there are fewer properties being advertised in certain areas like Uthiru and Kikuyu. There are more property seekers who are interested in these locations.

Another factor is ‘over’ advertising on the same listing by multiple agents to the same audience, forcing them to lower their prices for them to be attractive/competitive.

3. Increase in Mortgage Enquiries

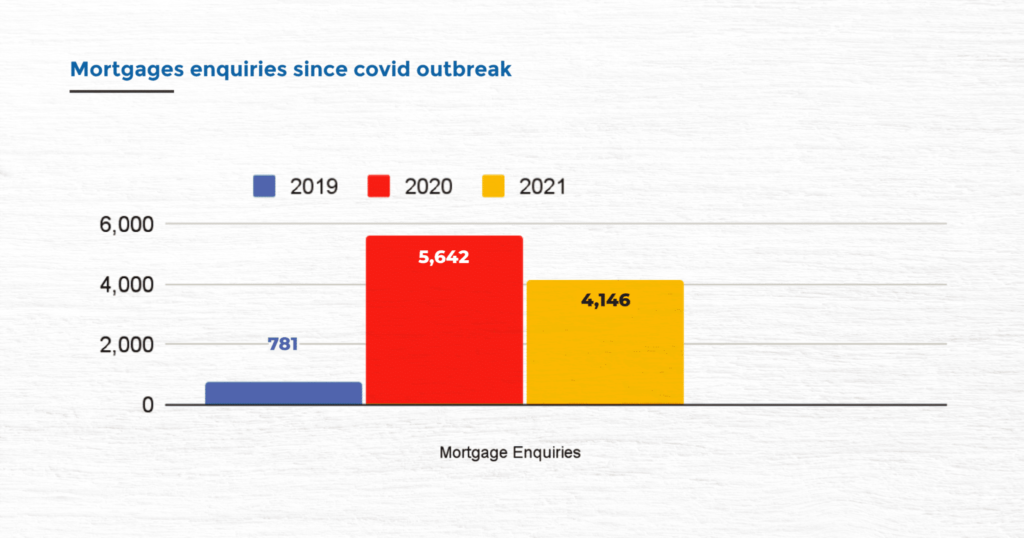

With most staff working from home, we have seen more demand for mortgages in the 2020-21 period compared to the previous 3 years, as shown in the yearly trend graph.

This is a 600% change over time, mostly seen in Q2 and Q3 of both 2020 and 2021. We expect the same trend this year, especially for more affordable areas such as Athi River, Ruiru and Ngong.

Despite the demand, many people are defaulting on payments due to pay cuts or job losses, which has led to several properties being auctioned.

4. Developers with Affordable Properties

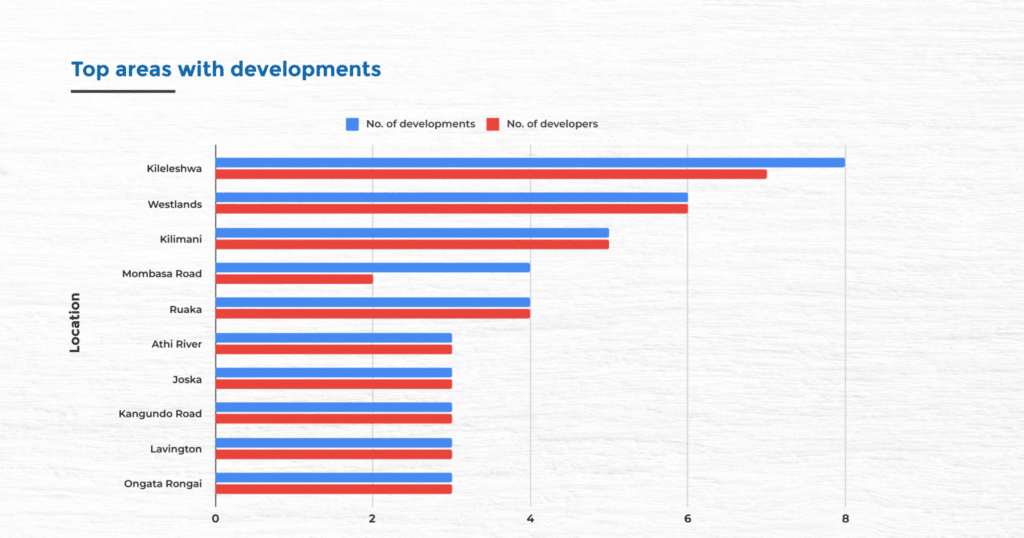

There are more developments/developers in the market with more affordable properties, especially in the outskirts of Nairobi and the coastal counties.

In 2021, there were 82 recent developments and 71 developers advertising on BuyRentKenya.

The new developments were quite widespread in over 30 locations, with some of the top areas as shown below.

Worth noting is the shift in the average rental price of recent developments from Kshs. 95,000 to Kshs. 65,000. The major driver for this was more affordable housing being built in more locations.

Similar to rentals, sale developments pricing has dropped to an average of Kshs. 11,800,000 from Kshs. 15,000,000.

This change in tactic by developers has led to a 30% increase in conversions, with more seekers having more confidence/will to purchase a home.

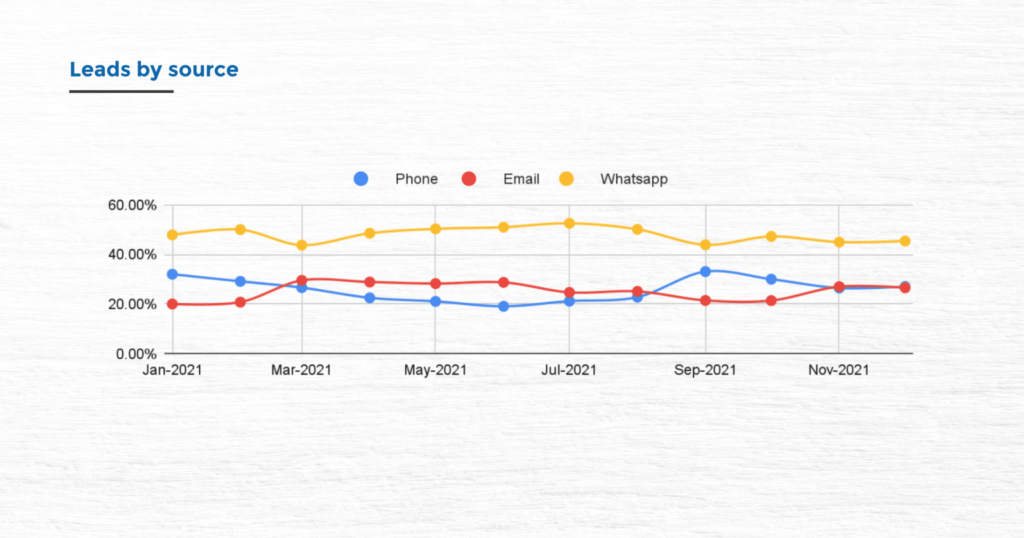

5. The Preferred Mode of Communication

WhatsApp is a critical and preferred medium of communication with property seekers and can improve conversions if utilised optimally.

In this day and age where WhatsApp is the primary means of communication, over 45% of our leads come from WhatsApp, as shown in the split graph below.

The diaspora audience mainly prefers it to email with most of their leads being for sale properties.

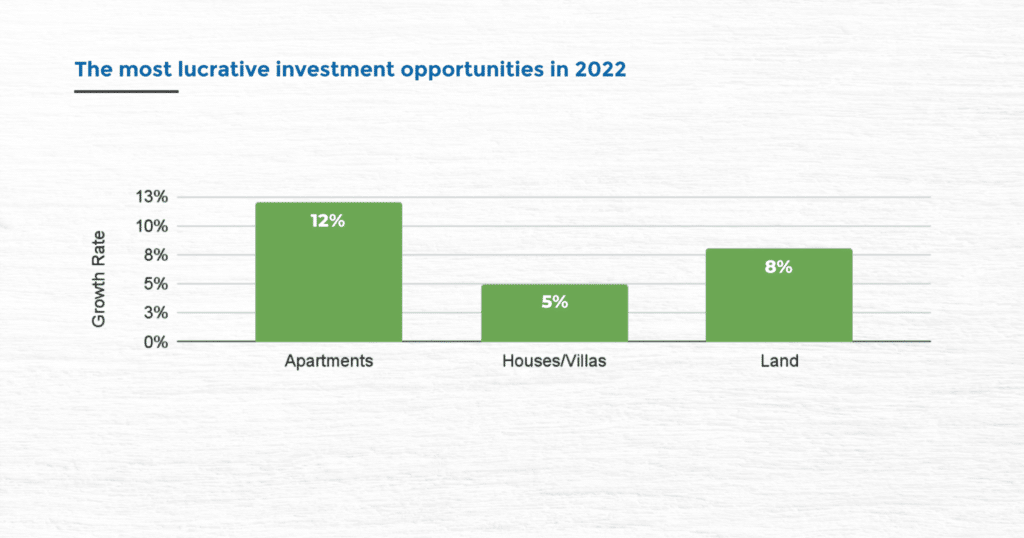

6. The Most Lucrative Investment Opportunities in 2022

For property types that have shown growth and potential, here is the breakdown; apartments between Kshs 2M and Kshs 15M, land between Kshs 170K and Kshs 2M for a 50 by 100 and finally houses between Kshs 5M and Kshs 25M all depending on the locations.

Below is an average growth rate for the three property types highlighted above to give you an idea of the current projections that will probably guide the real estate industry in the next few months.

Disclaimer: The impending elections and political climate may affect some predictions here.

For more information, contact Robert Ombaka – Business Analyst

Email: roberto@roam.africa