- In 2022, Acorn Holding Limited announced a plan to invest Ksh 3.6 billion in hostels.

- Studies show there are over one million post-secondary educational institutions and vocational centers in Kenya, which has led to increased demand for hostels.

- Hostel rooms occupy less space than apartments and have shared bathroom facilities. Making them more profitable per square meter.

With most young people moving to urban areas, this trend has come with a growing demand for affordable accommodation.

Hostels have become an increasingly popular option for young people looking to live in an affordable, safe, secure, and fully furnished living space. Not to mention most of these establishments are in strategic locations, preferably within the city.

READ ALSO: 2022 Real Estate Trends and What to Anticipate in 2023

Unlike renting an apartment, hostels come with free Wi-Fi, a cafeteria, a movie room, a laundry room, in some cases, a gym, and other recreational facilities. This makes them a more favorable accommodation option.

Table of Contents

Current Developments in the Student Housing Market

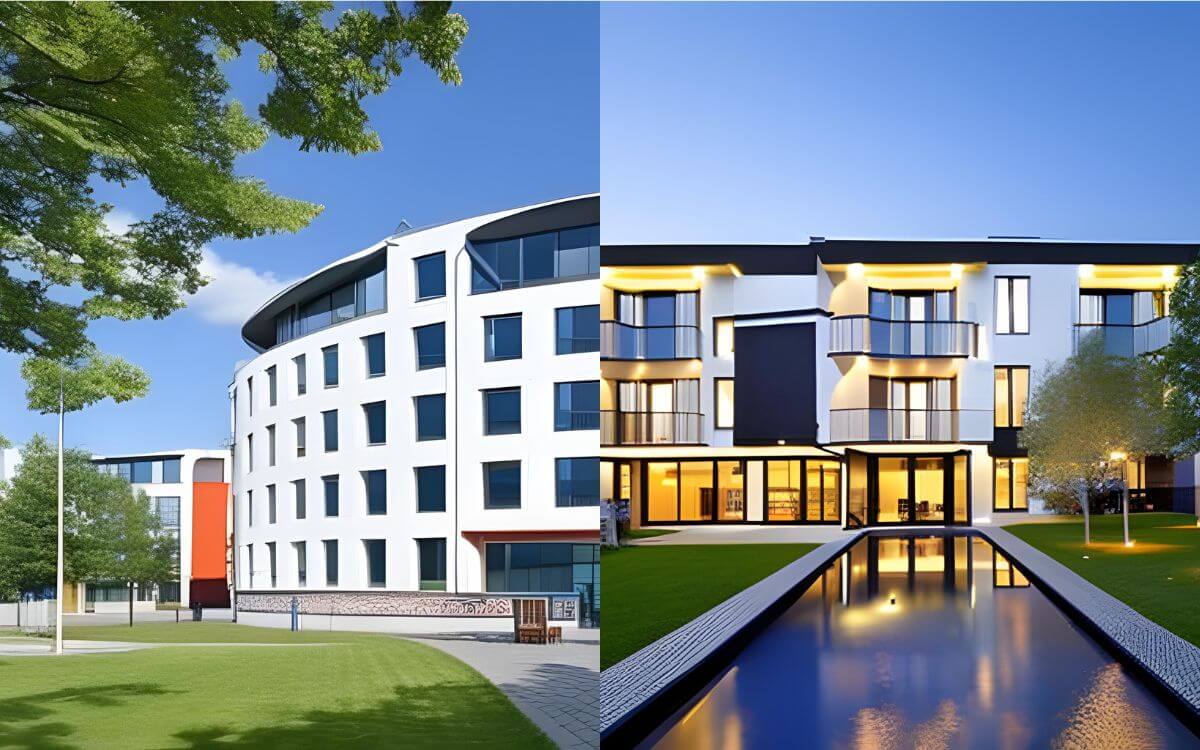

One of the Real Estate Investment Trusts issuers, Acorn Holding Limited, focuses on developing hostels under the Qwetu and Qejani brands.

According to the company’s CEO, they plan to develop three other hostels with 7000 beds. This is aimed at housing both students and young working adults.

“The facility we are unveiling today will provide a further 12,000 beds making the Acorn student housing portfolio the largest such portfolio in Africa with over 21,000 beds,” Acorn Holdings Limited Founder and Chief Executive Officer Edward Kirathe said.

In 2018, Kuramo Capital, a New York-based fund, invested in Century Developments Limited. The company intends to build a 10,000-bed hostel to cater to students’ rising demand for affordable living space.

Additionally, in 2021, Student Factory Africa broke ground on a Ksh. 5 billion hostel project in Karen. The project is expected to house 4,500 Catholic university students and will consist of 10 five-story buildings.

Why Are Hostels a Lucrative Investment?

To elaborate on the beautiful nature of hostels as an investment, consider the space it takes to house a single bed plus a study table compared to an apartment unit.

Factoring in the shared bathroom facilities, hostels are a much better use of space as you get more money per square footage.

READ ALSO: Pros and Cons of Investing in Real Estate in Kenya

Four students paying Ksh12,000 each to share a room gives you Ksh 48,000, whereas you need a two-bedroom apartment to earn the same rent for a traditional apartment.

Unlike other rental-based real estate ventures, hostels are guaranteed of all year demand, especially if they are strategically located and comprise modern facilities.

Students are more likely to select housing with modern furnishings, consistent water and electricity supply, several recreational facilities, and access to hot food, entertainment, and other convenient services.

More and more young adults are choosing to live in hostels while working instead of renting apartments.