After reading this article, you’ll wish you bought a townhouse in Kitengela or an apartment in Ruaka back in 2016 seeing that the value of property in these areas continues to rise. For those who did, 2019 is the year they’ll reap their investments greatly and we have the stats to prove it!

BuyRentKenya.com looks at the property price trends over the past 3 years which show that there is a 45% increase in the ratio of property seekers to property listings and implies there is increased demand and restricted supply. For purposes of this article, we will focus on 3 bedroom apartments and townhouses for rent and for sale in the top suburbs in Nairobi and the emerging towns. We will review pricing trends on how they performed in 2016 up to 2019.

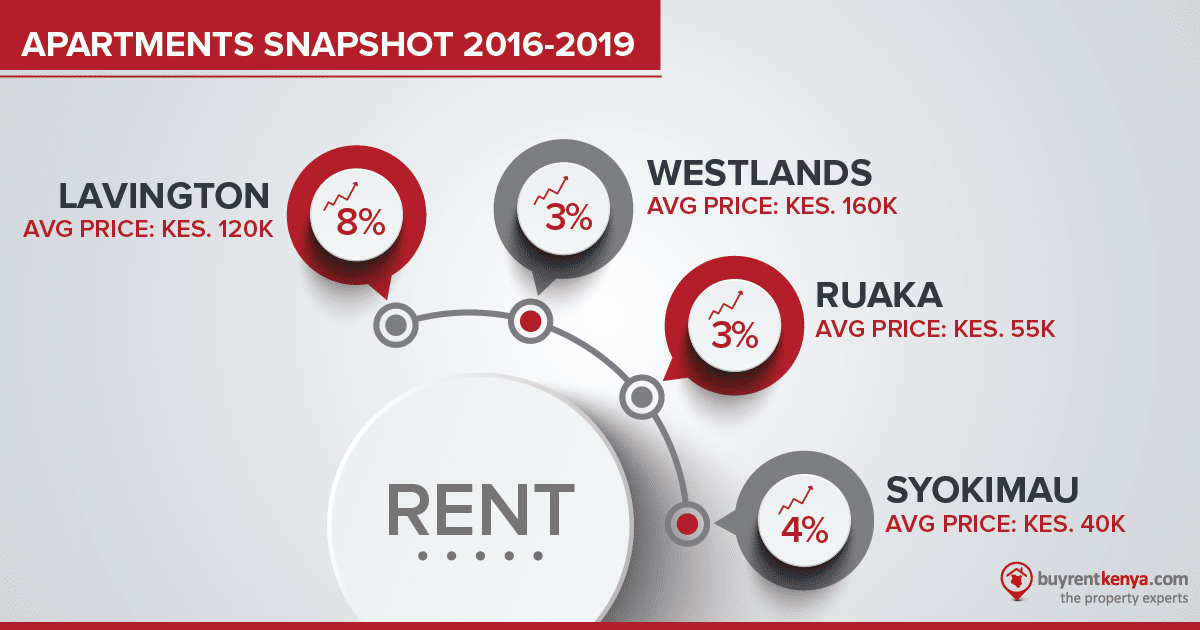

As shown in the above infographic, rental prices in Lavington went up by 8%. Because of this rise, houses remain vacant for long periods forcing investors to provide short-term occupancy. The story is similar for Westlands, where the price has gone up by 3% from KES 150,000 to KES 160,000 over the past three years. Westlands is home to major hotel brands which hold conferences and meetings which attracts the expatriate community. The middle and working class keep growing with more high-income earners choosing to live close to the city centre.

| Apartments for Rent ( Average Prices in KES) | |||||

| 2019 | 2018 | 2017 | 2016 | YoY | |

| Lavington | 120K | 110K | 110K | 90K | 8% |

| Parklands | 150K | 150K | 120K | 150K | 1% |

| Kilimani | 120K | 150K | 140K | 130K | -5% |

| Westlands | 160K | 150K | 120K | 150K | 3% |

| Ruaka | 55K | 50K | 45K | 50K | 3% |

| Rongai | 40K | 35K | 30K | 40K | 1% |

| Ngong | 60K | 60K | 65K | – | -2% |

| Syokimau | 40K | 40K | 40K | 35K | 4% |

Rental prices in Ruaka grew by 3% over the last three years as shown in the above table. Ruaka has grown because it has the biggest mall in East Africa, Two Rivers, as well as Rosslyn Riviera, and Village Market. It is also located next to the UN offices. As a satellite town, demand for housing in Ruaka continues to grow from the construction of the Northern Bypass which makes transportation easier and faster into the city centre. In years to come, we expect to see high-end houses come up in the area and other property types like offices and retail stores to cater to the people living and working in Ruaka and the surrounding suburbs.

There was an increased demand for housing in Syokimau as seen in the 4% increase in rental prices over the past 3 years. With the close proximity to the Jomo Kenyatta International Airport, access to Mombasa Road and the train network, Syokimau is attracting both homeowners and developers.

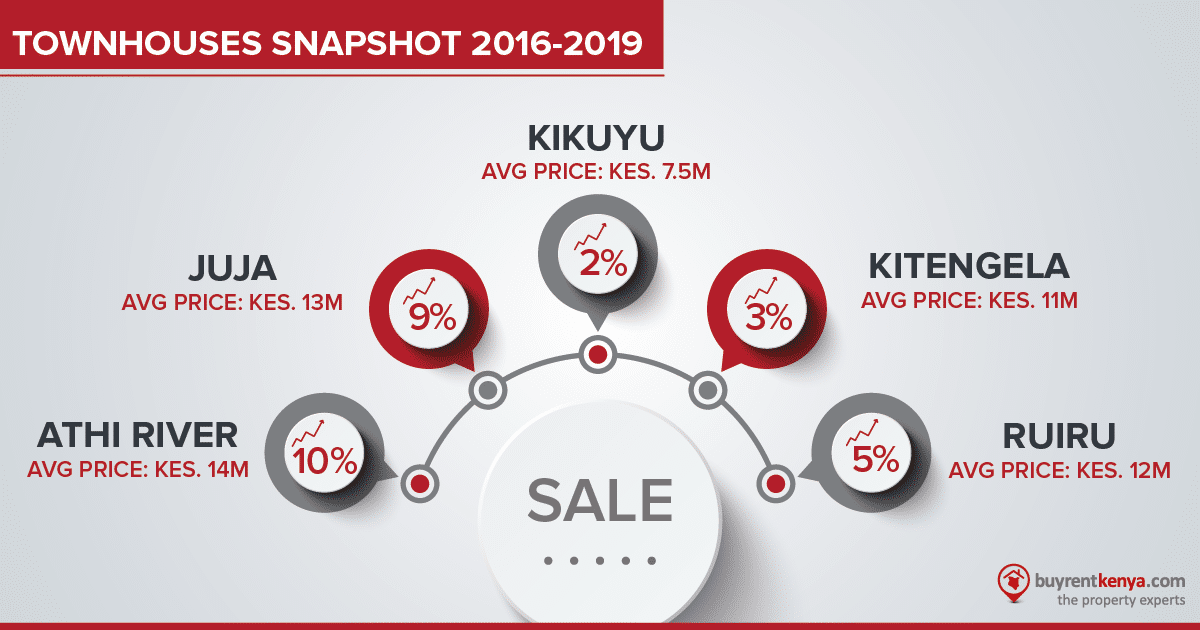

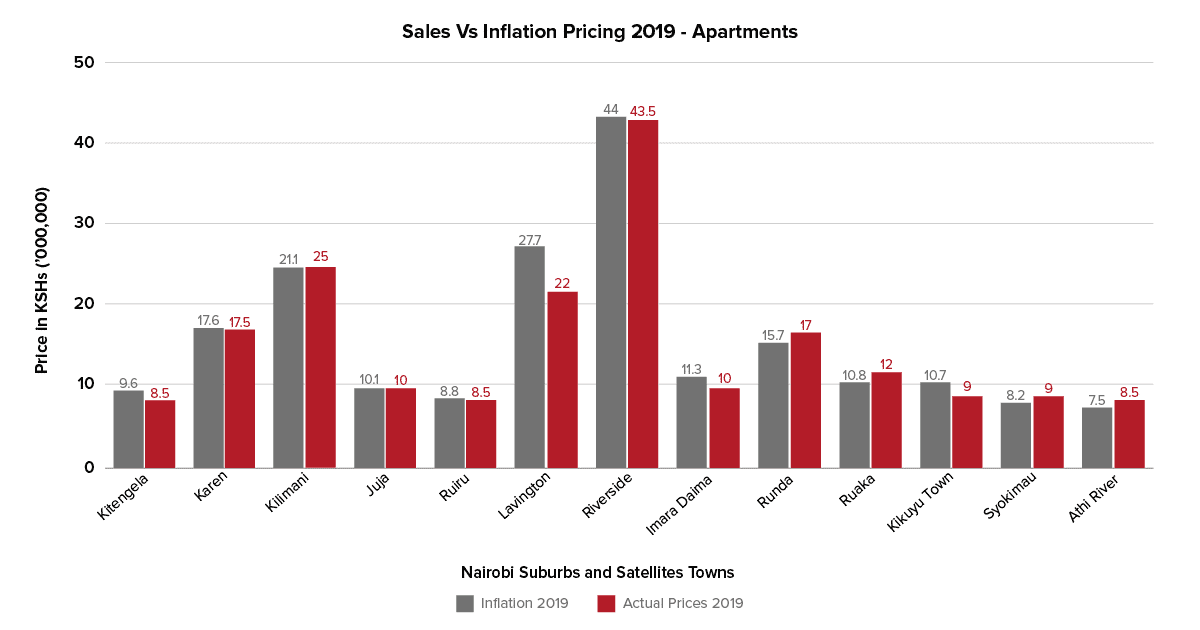

In emerging satellite towns, demand for townhouses for sale is on the rise as shown in the above infographic. In Kitengela, the price of an apartment for sale increased by 3% over the past 3 years while that of townhouses was up by 11%. With the average price of an apartment going for KES 8M, it is actually cheaper to buy an apartment in Kitengela in 2019 against the predicted KES 9.6M using the inflation rates from the Central Bank of Kenya.

Homeowners are investing in Kitengela due to the availability of social amenities such as good schools, shopping malls and hospitals. Additionally, because it is easier to get manpower and building materials, these satellite towns are good areas to invest in.If you are thinking of buying an apartment or townhouse in Athi River, it will be more expensive for you. As demand goes up in these areas, the value of property goes up. If you want to sell your house, now would be a good time to do so.

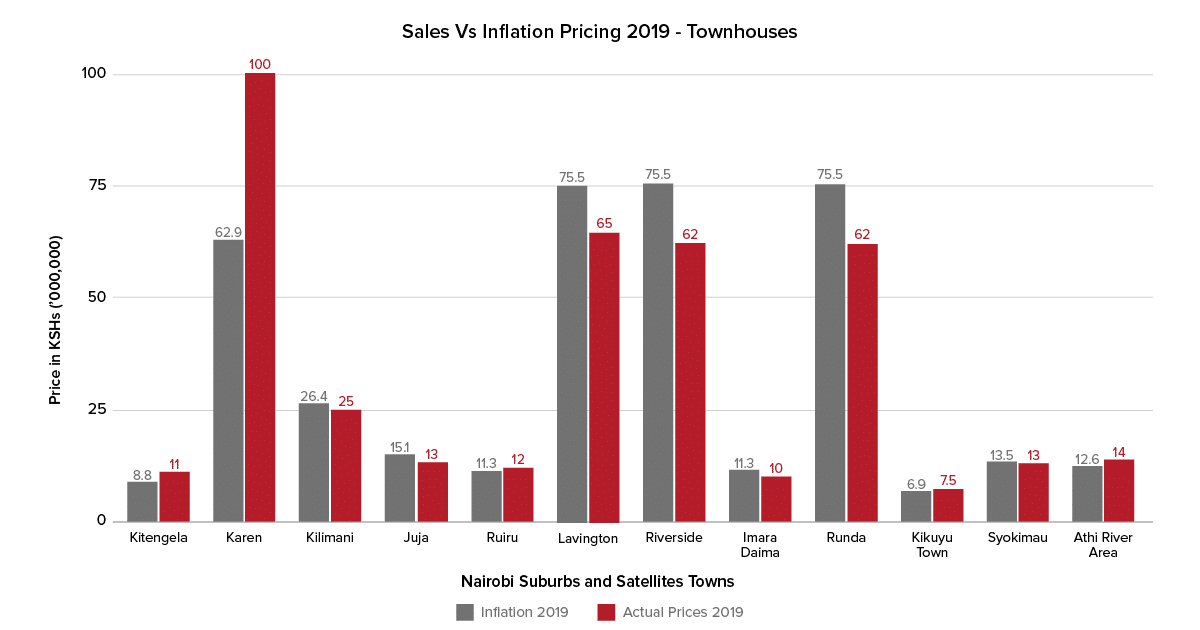

Interestingly, when looking at inflation rates compared to rising property prices, we have noticed townhouses are more expensive compared to apartments in the same area. This is especially evident in Lavington and Riverside. In places like Juja and Ruiru, there is no major change in current sale prices against the inflation rates. Prices are growing as expected because there are no major developments in these areas.

Table of Contents

Inflation Vs. Actual Prices

Whether you want to buy or sell a home, you need to understand the effect of inflation on house prices. When inflation is high, house prices increase, and vice versa. With reduced inflation rates, general living expenses go down. When the price of a property is below the increased inflation level, it is cheaper than it was the prior year, often making this a buyer’s market.

Market Predictions

Following the price trends we have seen in the market coupled with changes in demand and supply by area and infrastructure improvements, we foresee the buyers and sellers market vary by area. Largely, we see an increase in supply and demand in areas on the outskirts of Nairobi due to infrastructure improvements making it easier for commuting to Nairobi while spending less on property respective to Nairobi properties. Apartment prices are set to increase in high-demand areas of Riverside and Runda with further townhouse price increases expected for Karen, Kitengela, and Kilimani.

We foresee stagnant prices in Lavington for apartments and townhouses. BuyRentKenya.com’s market predictions are based on pricing shifts, economic key drivers, and real estate trends. However, there may be external factors that impact whether our predictions come to fruition. In conjunction with our pricing review, the information below will help property seekers and investors make informed decisions to get better returns on their investments.

1. Affordable Housing Project

During the election period in 2017, most businesses adopted a wait-and-see attitude because they were unsure about what would happen in the country. After the 2018 political handshake, Kenya saw stability return in most industries including real estate. The real estate market in Kenya operates in different cycles which usually starts after a general election up to the next one.

From election promises to action, the President’s “Big Four Agenda” pioneering the affordable housing project which will make it easier for Kenyans to own homes. According to Business Wire, this agenda will be further aided by a boom in the cement industry from the reduction in construction prices across public and private developments. This will encourage suppliers and local contractors to find innovative ways of implementing the affordable housing project.

2. Borrowers to Pay Higher Interest Rates

The courts recently suspended the banking interest rate cap aimed at improving lending terms to consumers. They will now have to wait for finalisation of the cap in the next 12 months. This will allow regulators enough time to put in the right mechanisms to help consumers. In the interim, banks will raise their interest rates which will be a big blow to borrowers who want to get mortgages.

3. Taxes Will Increase

Big changes take time and toll with ordinary Kenyans bearing the burden of funding the affordable housing project. Additionally, the housing beneficiaries will have to wait for five years before they can access the money to buy a home. The government has proposed a 0.5% personal income tax increase, which is to be implemented in March 2019, to help fund the project. The Ministry of Housing and Urban Development wanted the tax rate to be 5%, however, the rate could still go up progressively. Potential homeowners can use these savings to negotiate for better mortgage rates. Good news is that inflation rates will decrease to a stable 5% by 2022 according to Statistica after several tumultuous years. Hopefully, this will reduce the cost of living for many Kenyans and ease the increased tax burden.

4. Inflation Rate in Kenya

Statista’s predicted stable 5% inflation rate by 2022 means there will be more disposable income. This means money which was being spent on commodities such as food, transport, fuel, and clothing can be spent on housing. At the same time, lenders offer lower interest rates, making it easier to get a reasonable mortgage. Plateauing stable inflation indicates market stability which is a positive sign towards long term growth for Kenya.

5. Encourage Government Partnerships

The government needs to work hand-in-hand with private sector industry players in order to propel the real estate sector in Kenya. There is a scarcity of land to build new projects yet the government still possesses a lot of land which is currently not in use.

In summary, one major focus for 2019 is affordable housing which will provide low-cost housing to both low and middle-class income earners. Real estate developers and real estate agents experience challenges with offloading their property as supply increases to match demand. Online property platforms such as BuyRentKenya.com will continue to provide digital solutions to cater to the whole property ecosystem. This will also make it easier for property seekers to find houses within their budget in a convenient way.